Travel insurance. One of those ‘must haves’ that you pay for hoping that you’ll never have to actually use it. You trawl through the internet trying to find the best deal possible, pay the premium and fingers crossed, never have to think about it again.

Unless you have to make a claim.

Which is exactly the position we found ourselves in earlier this year, thanks to some scumbag in Tenerife making off with two rucksacks full of valuables, kit and clothes, having smashed their way into a secure car. We had insurance, but having to go through the rigmarole of making a claim and the very disappointing end result made me think, ‘was it actually worth it?’

Is travel insurance worth having?

Don’t get me wrong, we would never travel without insurance. Should the unfortunate happen, you don’t want to be in the position of needing medical treatment and not being able to afford the cost, or not being able to afford legal advice or repatriation. For that alone we’ll always, and you should always, have travel insurance. But what I want to specifically look at is the baggage/personal effects element of the insurance, and why that may not be all it’s cracked up to be.

Before I go too far though, a couple of ‘disclaimers’.

- I’m not going to name the insurance company involved. Their terms were really no different to most other travel insurance policies.

- I get insurance through work, paying a monthly premium for a policy that includes a range of insurance benefits including worldwide travel for myself and Her Ladyship.

- I’m not naïve. Insurance companies are businesses, and will try and limit their payouts in order to make a profit. In this respect they can be ruthless. I guess it wasn’t until I had to make a claim, that I discovered just how ruthless they can be.

– End of disclaimer –

Our experience with travel insurance

When the theft in Tenerife occurred, and we took stock of the cost of the items taken and other expenses we’d incur as a result, our attitude was ‘let’s not worry about it now, we can claim on the insurance’. We weren’t going to let the incident define our trip and had no choice but to pay out for Emergency Travel documents and transport to the British Consular Office and the local police station.

Read more: Having our passports and luggage stolen in Tenerife

It wasn’t until our return to the UK when I looked at the paperwork and realised two things:

- We’d be lucky to recover even half of the cost of the incident

- The insurance company doesn’t make it easy to make a claim!

I get it, the insurance company want to protect themselves against fraudulent claims, but jeez, what an absolute ball-ache the form completion was.

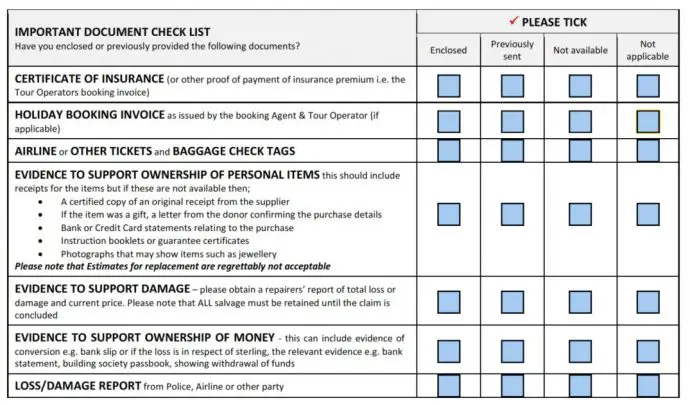

The first part was proving we had insurance, and that we’d been on the trip, as well as having a police report (which in itself was a nightmare to get in terms of language barriers, time taken and inconvenience…although the police on the island were fab!). All fairly easy documents to provide, once we’d rounded them up.

Making the Travel Insurance Claim

It was when I started listing the items stolen that the ‘fun’ began. Logic suggests that we’d have to prove ownership of the items stolen, but this wasn’t something I had ever actually considered before. It’s easy if the items are new and you still have the purchase receipt. But if like me, unless it was something like a camera, you chuck receipts out, meaning that proving ownership suddenly becomes an infuriating task.

For example, I had a coat stolen. The coat was well out of manufacturers’ warranty, so I hadn’t kept the receipt. To replace the coat would cost over £120, so I wanted to make a claim. But I had no idea when I had purchased the coat, how much it cost originally and where I had bought it from (I couldn’t even tell you if it was an online purchase or not). Now, the claim agency operating on behalf of the insurance company does accept photographs as proof of ownership, if certain criteria are met. So, trying to find a picture of me wearing the coat, with the logo visible and preferably on the trip (to prove that I had taken it), wasn’t easy as you can imagine.

This had to be done for every item we didn’t have a receipt for. Trawling through hundreds of pictures trying to find ones that met the criteria took hours. Almost to the point of ‘is this actually worth our time?’. But we persevered, after all, I’ve paid thousands of pounds over the years into the policy, why not get back as much as possible?

As it turned out, we didn’t receive that much in compensation. Did I mention the insurance company was ruthless? We just scraped over £1000 back from an incident that in total cost us over £2500 – OUCH! And here’s how.

Watch out for the small print

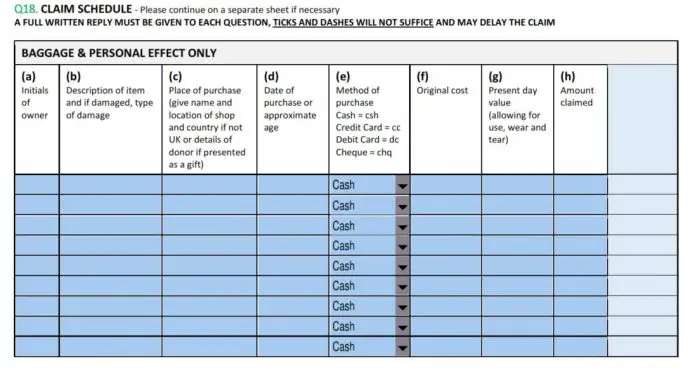

Camera and Accessories

The biggest single expense was the camera, which would cost £600 to replace. I knew the policy had an upper limit of £500 for an individual item, and to be fair, when I considered the age of the camera, I’d put its present-day value under £500. So, I was confident I’d get close to the claim request. Wrong.

I also tried to claim for 3 spare batteries, 2 memory cards and a tripod, totalling around £250. However, the insurance company don’t view these type of items as separate from the camera itself. They lump all photographic equipment together and class it as one single item. With an upper claim limit of £500 for everything.

I’ll let you do the maths. Needless to say I lost out on several hundred of pounds because of their interpretation. Ruthless bast*rds.

Passports

The second biggest expense was the loss of our passports. Emergency travel documents to get us home cost £200, and additional car hire to get to the British Consulate was £35. Once home, under normal circumstances we’d go for the cheapest option to get new passports, but because we were due to travel to Kenya just nine days after our return from Tenerife, we had to opt for the fast track service if there was to be any hope of us making the flight. This cost us £284, not taking into account having to get new passport photos and the fuel costs of getting to the nearest passport office for an ‘interview’. We had also pre-purchased our Kenyan Visas, so we had to buy another visa each because obviously we would now have different passport numbers. Another £80. It adds up quickly!

We had no option but to pay out. But all of this was done with the knowledge that our insurance would

“Cover for reasonable additional travel or accommodation expenses you have to pay whilst abroad over and above any payment which you would normally have made during the trip if no loss had been incurred, as a result of you needing to replace a lost or stolen passport/driving licence”

And on initial contact with the claim’s agency, they said they “should be able to assist” with the costs associated with our loss, as we had, in our minds, exercised “reasonable care for the safety or supervision of your passport” considering we had been told to have our passports with us. They had been locked in a car out of sight.

But the insurance didn’t pay out single penny for any cost relating to the theft of our passports. Why? Well buried deep in the policy document, and I mean deep – we’re talking appendices to small print sections deep – I found this definition:

![]()

Eh? How can a passport be defined as money! But that’s just what the insurance company had done.

So, I looked up claiming for loss of money because now there was no point looking at the specific section for passports! And there it is was:

“Summary of Cover for accidental loss or theft of your own money whilst being carried on your person or left in a locked safety deposit box”

Because our passports were not taken from a safety deposit box or directly from our person, there was the insurance company’s get out clause. They weren’t interested one little bit that the passports were locked in the boot of a car.

Most other travel insurance polices aren’t any better

It seems though that this is common! Having now done some research, I found other insurance companies that define passports as ‘money’ and have the same claim criteria attached.

I also stumbled across a recent news article whereby a couple were driving their hire car back to an airport to catch their flight home. Stopping for lunch, all their luggage was left out of sight in the boot of the locked car including their carry-on bags with passports. When they got back to the car after lunch, everything had been stolen out of the car. Their insurance refused to pay out for any claim relating to the stolen passports because they had not been on the victim’s person or locked in a safety deposit box. This made me think of all the times we have self-driven (South Africa, Swaziland, Slovenia, Mauritius) and stopped for a comfort break and left passports in the car!

After a bit of research I discovered that most travel insurance policies are very similar to ours, and some were even less accommodating, which was surprising. I even looked at insurance policies for travellers designed by travellers and found that some aspects of my travel insurance are better than those specifically created for the type of travel we like to do!

So, no matter what travel insurance policy we choose, we know we’re going to be majorly out of pocket should another incident occur. They really all seem pretty much as bad as each other.

Tips to make your travel insurance claim easier

- Keep all your receipts! Just on the off chance that in 8 years time you need to prove ownership of a toothbrush.

- Lock your passports in the hotel safe, and ignore the rules that say you need to carry your passport with you (like they did in Tenerife when we hired our car). Just take passport photocopies to carry around instead.

- Remember a good insurance policy isn’t necessarily the one that has the highest claim limit.

- Consider getting a separate camera specific insurance policy, which is what we have now done.

Informative article many thanks. My beef at the moment is actually getting travel insurance to go to kenya. With it not being on ‘the green list its proving impossible. Also I dont understand why kenya is not on list as Covid is much less severe there than on Europe

Hi Paula, thanks for stopping by. It’s so frustrating at the moment isn’t it, especially as the situation in different countries and the associated rules seems to be changing almost daily. Kenya is a wonderful country, so I hope you manage to sort something out soon, good luck!